Regarding homeownership, comprehending your mortgage is crucial. Many homeowners often find themselves caught up in the excitement of acquiring a new home, but after the dust settles, it’s important to take a more thorough look at what you really owe. Beyond just just the monthly payments, several factors come into play that can affect your overall financial situation. A clear grasp of your mortgage can help you avoid surprises in the future and prepare you for a promising financial future.

Calculating your true mortgage involves more than just tallying numbers; it requires an understanding of various factors including rates of interest, loan terms, and additional fees. By utilizing a mortgage calculator, you can gain valuable insights into your financial commitments. This tool can help you review your current mortgage and prepare for future payments, ensuring that you have a realistic understanding of your financial reality. Whether you're new to purchasing homes or considering refinancing, knowing how to calculate what you really owe can make all the difference in your homeownership path.

Comprehending Your Home Loan Terms

To accurately determine how much you really owe on the home loan, it's crucial to comprehend the main terms involved. The loan principal is the initial loan amount, while interest is the fee of borrowing that funds, expressed as a proportion. Various loan types, such as fixed-rate and adjustable mortgages, also influence your payments and how much you will ultimately pay back over the duration. Being familiar with these concepts will enable you to evaluate your monetary commitment more efficiently.

An additional crucial term is the amortization schedule, which details how your payments are distributed over the life of the loan. In the early years, a larger portion of your payment goes toward interest rather than principal. This means you may not see a significant reduction in your balance initially. Understanding how HipoteCalc is scheduled helps you anticipate when you will gain equity in your home and how interest impacts your cumulative payment.

Lastly, hidden costs can affect your overall mortgage situation. Property taxes, insurance, and fees may not be counted in the monthly mortgage payment but can considerably impact your total financial responsibilities. Using a mortgage calculator can aid you in factoring in these extra costs, offering you a more clear picture of what you owe and helping you formulate your long-term financial strategy.

Employing a Mortgage Estimator Effectively

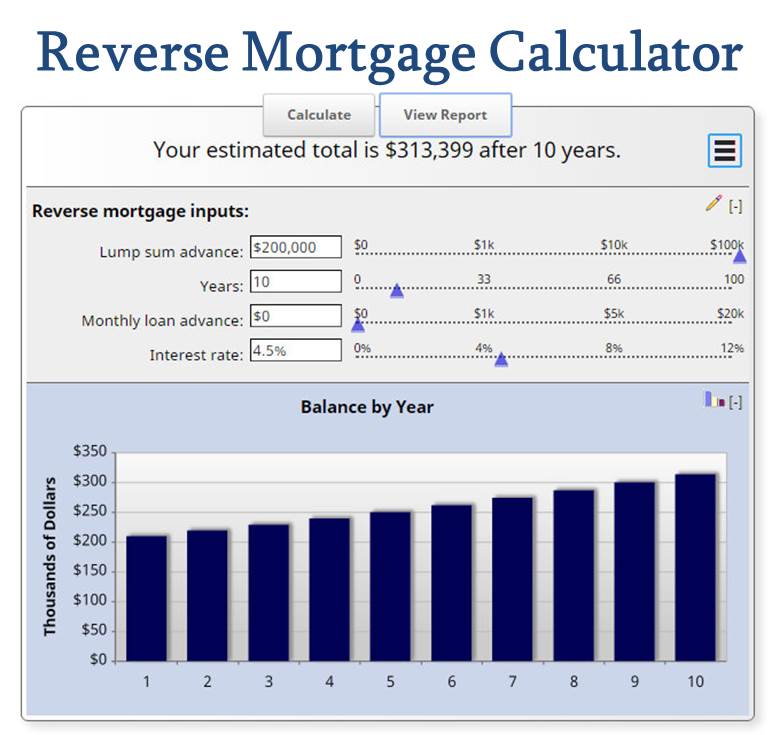

To gain maximum benefit of a mortgage calculator, begin by collecting all relevant financial information. This entails your home price, down payment, interest rate, loan term, and any relevant additional costs including property taxes, homeowner's insurance, or private mortgage insurance. Having precise data at your fingertips will ensure that the calculations reflect your true mortgage situation, allowing you to make intelligent decisions.

Once you have entered the essential information, focus on modifying different parameters to see how they influence your monthly payments. For instance, test with different interest rates and down payment amounts to understand their impact on your overall mortgage cost. This dynamic approach can reveal how even minor changes can result in significant savings over the life of the loan, providing clarity on what you might practically be able to manage.

Finally, think about using the results from the mortgage calculator to analyze various loan options. Look closely at the total interest paid over the term of the mortgage and how different loan terms might affect your future obligations. This comprehensive analysis will assist you grasp not just what you owe monthly, but how to arrange your mortgage in a manner that aligns with your financial goals.

Assessing Your Total Mortgage Outlays

Understanding the total mortgage costs extends more than just the principal amount borrowed. It is crucial to factor in interest rates, loan terms, and supplemental fees that might emerge throughout the duration of the loan. The starting mortgage amount is merely the starting point; interest accumulates over time, and a seemingly small percentage rise in rates can result in a substantial rise in what you finally pay.

Another key factor to evaluate is private mortgage coverage, or PMI, which might be necessary if the down payment is less than twenty percent. PMI adds to your monthly payment and can affect your overall budget. Additionally, further potential costs such as homeowners insurance, property taxes, and escrow fees are often rolled into the mortgage payment, making it vital to include these into the total cost calculations.

Using a mortgage calculator can be immensely helpful in evaluating your total mortgage costs. These tools allow you to input different parameters, including interest rates, loan amounts, and terms, giving you a more accurate picture of the financial obligations. By projecting multiple scenarios, you can more easily comprehend how changes in the financing choices will affect what you really owe over the life of the mortgage.